End-to-end banking IT services for innovation and operational excellence

Since 2017, we have delivered banking IT services that empower financial institutions to modernize, scale, and stay secure. From custom banking software to integrated platforms for core banking, payments, compliance, and risk management, we build future-ready banking IT solutions that drive performance and elevate your customer experience.

8+

Years of Expertise

350+

Our Global Clients

180+

IT professionals

1000+

Completed Projects

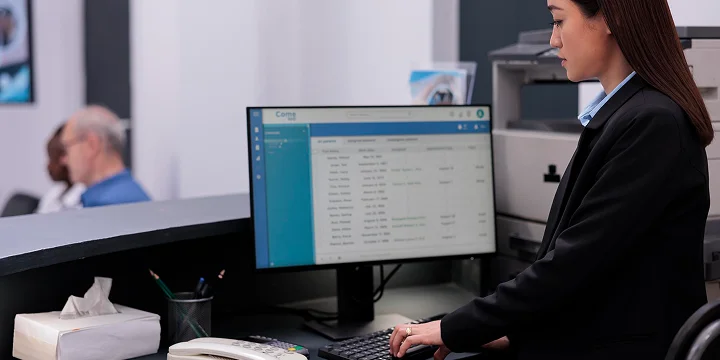

As the financial industry embraces rapid digital transformation, today’s customers demand more than traditional banking, they expect secure, seamless, and always-available digital experiences. From mobile apps to online banking platforms, the technology behind these services has become central to customer engagement and operational efficiency.

At Celestial Infosoft, we recognize the strategic importance of IT in the modern banking industry. Since our inception, we’ve partnered with financial institutions to deliver enterprise-grade banking IT services designed for performance, compliance, and scalability. Our offerings include custom banking software, mobile banking applications, digital payment integration, core system modernization, risk and compliance solutions, and ongoing IT support. We don’t just build systems, we build digital ecosystems that empower banks to lead in a competitive landscape.

\ Our services \

With customers expecting 24/7 banking on the go, we design user-centric mobile banking apps that combine real-time transaction capabilities, secure authentication, personal finance features, and AI-driven product suggestions, all in a seamless interface.

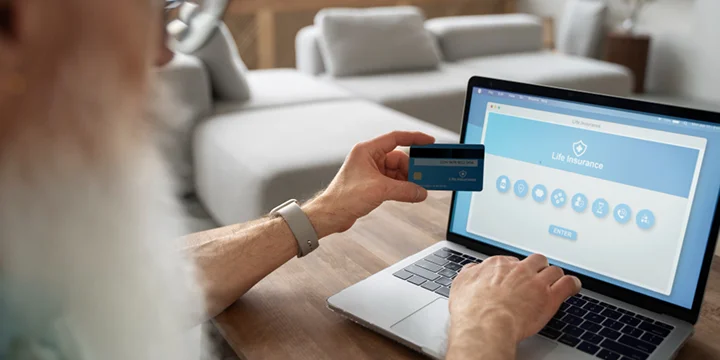

Empower your customers with secure, intuitive web portals to manage their accounts, request services, initiate transactions, and access financial tools, all with multi-device access and role-based permissions.

We develop flexible and modular core banking platforms that streamline essential operations like customer onboarding, account management, transaction processing, and compliance workflows, whether you're upgrading legacy infrastructure or building from scratch.

We develop secure and high-speed digital payment systems, including P2P transfers, merchant payments, mobile wallets, QR/NFC-enabled apps, and integrated payment gateways, all built for performance and compliance.

Help clients make smarter financial decisions with platforms that support portfolio tracking, risk analysis, robo-advisory, and regulatory reporting. Our solutions enable both managed and self-directed investment strategies.

Mitigate threats with AI-powered fraud prevention and real-time risk scoring. We help you detect anomalies, monitor transactions, and maintain regulatory confidence through advanced analytics tools.

\ Our Work \

\ Our offering \

Evaluate existing banking IT landscape and digital maturity.

Define a transformation roadmap aligned with business goals.

Identify and prioritize key tech initiatives (cloud, mobile, AI, etc.).

Ensure regulatory readiness and operational resilience.

Deliver change management support and staff enablement.

Design and develop secure, scalable banking applications.

Build tailored solutions for core banking, lending, and customer engagement.

Incorporate mobile-first, cloud-native, and API-driven architectures.

Ensure compliance with financial industry standards and regulations.

Support post-launch evolution, testing, and feature expansion.

Audit legacy systems for performance, security, and scalability gaps.

Re-engineer platforms to modern frameworks or cloud environments.

Migrate data and processes with minimal downtime.

Improve UI/UX, speed, and operational efficiency.

Ensure continuity, regulatory compliance, and cybersecurity throughout.

Integrate new software with core banking systems and third-party tools.

Connect payment gateways, CRM, analytics, and compliance modules.

Optimize data flow across departments and platforms.

Configure secure APIs for real-time connectivity and automation.

Handle testing, deployment, and post-go-live support.

What makes Celestial different

To our clients, there is no middle ground. When it comes to your success, and it is our business to make it happen. We don’t stop till you meet every technical goal. We are here for you, and as your team, It’s our responsibility to understand and implement your requirements.

\ Why we \

With deep domain knowledge and years of experience, we understand the complexities of banking systems and compliance needs, delivering secure, scalable, and regulation-ready solutions.

We don’t offer one-size-fits-all products. Every solution is tailored to align with your goals, workflows, and customer expectations, ensuring maximum ROI and future growth.

Clients see us as more than a vendor; we act as a strategic partner. From consulting to post-launch support, we stay involved, responsive, and committed to your success at every stage.

\ You're Just One call away \

Quick form to get started

We discuss goals & possibilities

Clear plan, no surprises

We work on your dream.

\ Few Words \

"Celestial Infosoft helped us completely modernize our core banking infrastructure without disrupting daily operations. Their deep understanding of both technology and banking made the transition smooth and risk-free."

"We were impressed by how quickly Celestial’s team understood our regulatory challenges. Their compliance-first approach gave us peace of mind, and the CRM system they built has truly transformed how we manage client relationships."

"Our mobile banking app developed by Celestial Infosoft was a game-changer. It’s sleek, secure, and exactly what our customers needed. Their attention to UX and security was outstanding."

"Celestial’s end-to-end development and support model made them feel like an extension of our own team. Their ability to deliver complex systems under tight timelines is unmatched."

We wanted a true partner, not just a vendor. Celestial Infosoft delivered an elegant, secure, and user-loved banking app that’s become the digital face of our bank. Our transformation journey just got real.”

\ FAQs \

We work with a wide range of financial organizations, from commercial banks and neobanks to credit unions and fintech startups. Our solutions are scalable and adaptable to both traditional and digital-first banking models.

We follow global and regional compliance standards such as PCI DSS, GDPR, RBI, and more. Our solutions are built with regulatory frameworks in mind, and we integrate automated tools for KYC, AML, and real-time audit trails.

Absolutely. We offer modular modernization services that allow you to upgrade specific components, like APIs, UX, or data architecture, while keeping critical systems intact, minimizing disruption and cost.

Security is embedded in every layer of our development process. We implement end-to-end encryption, role-based access control, multi-factor authentication, regular code audits, and continuous security testing.

We are curious to discuss your dream project!

Years of Expertise

Projects Completed

IT professionals